Everyone’s a Warren Buffett in a Bull Market—Until They’re Not

In bull runs, everyone is Warren Buffett In bear runs, everyone quotes Warren Buffett

When the market’s soaring, it's easy to feel like a financial genius. Stocks keep climbing, profits are rolling in, and suddenly everyone thinks they’ve got the Midas touch.

They are full of opinions and theories they can even connect dots and make their opinion convincing. But here’s the catch—bull runs don’t last forever. The minute the market turns bearish, that’s when the real test begins.

In a bull market, everyone’s an expert.

You know the type—the friend who never stops talking about their latest “can’t miss” stock tip, or the coworker who suddenly knows everything about cryptocurrency.

During these times, it feels like there’s no way to lose. You buy a stock, it goes up, you sell, and repeat. Simple, right? It’s like we’ve all become mini Warren Buffetts, dishing out investment advice like we’re the Oracle of Omaha himself.

But here’s the reality check:

When the market takes a dive, that’s when everyone starts quoting Warren Buffett. Suddenly, those high-flying investors turn cautious.

The same people who were bragging about their 30% returns are now preaching Buffett’s wisdom: “Be fearful when others are greedy, and greedy when others are fearful.” It’s easy to say, but living by it? That’s a different story.

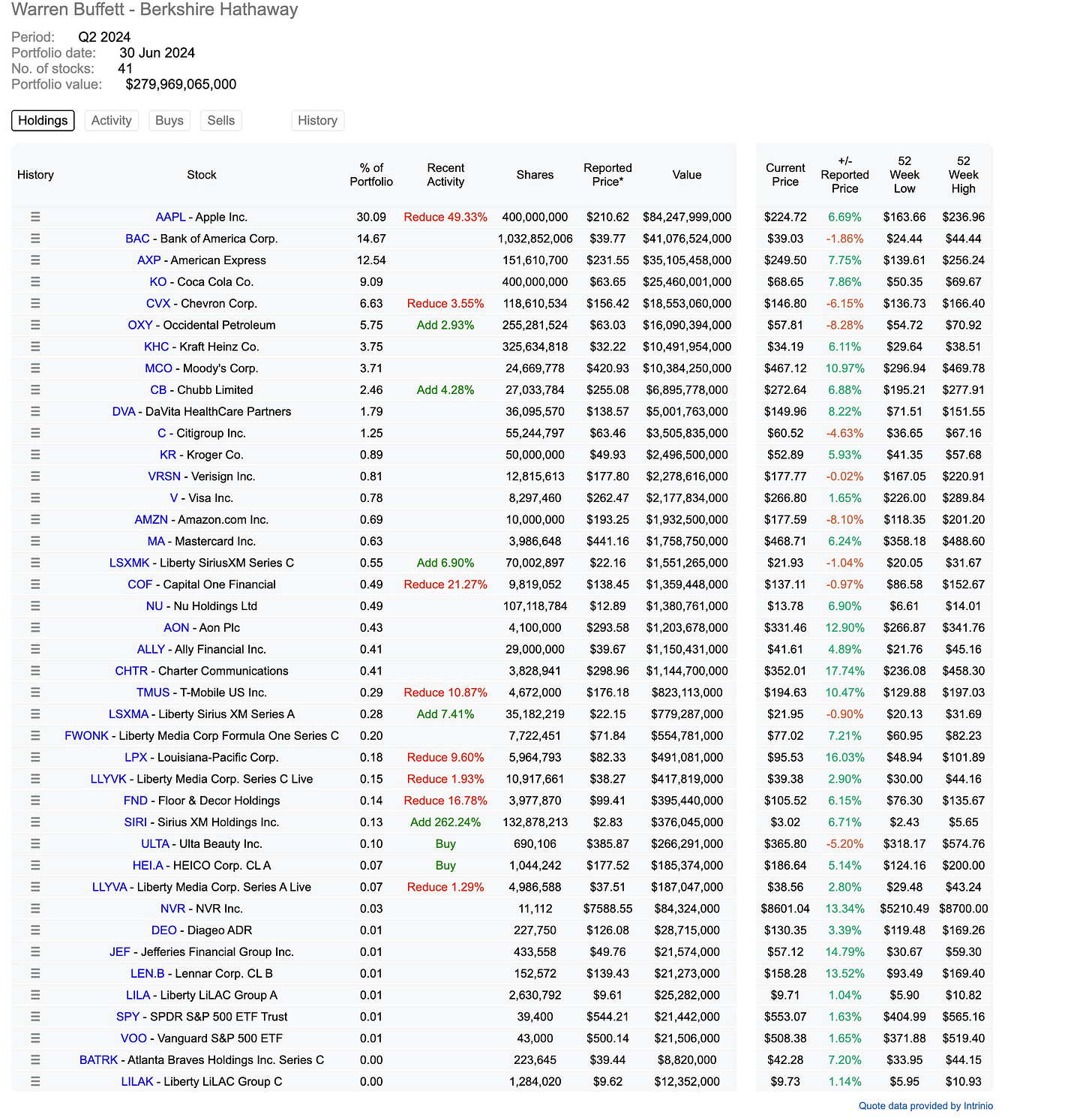

What does Buffett do in these situations?

He cashes in during the bull market and gets ready for the bargains that a bear market brings. He knows that the best opportunities often come when everyone else is running scared. That’s why Buffett’s not just rich—he’s consistently rich, in bull and bear markets alike.

The SEO Lesson from Buffett’s Strategy

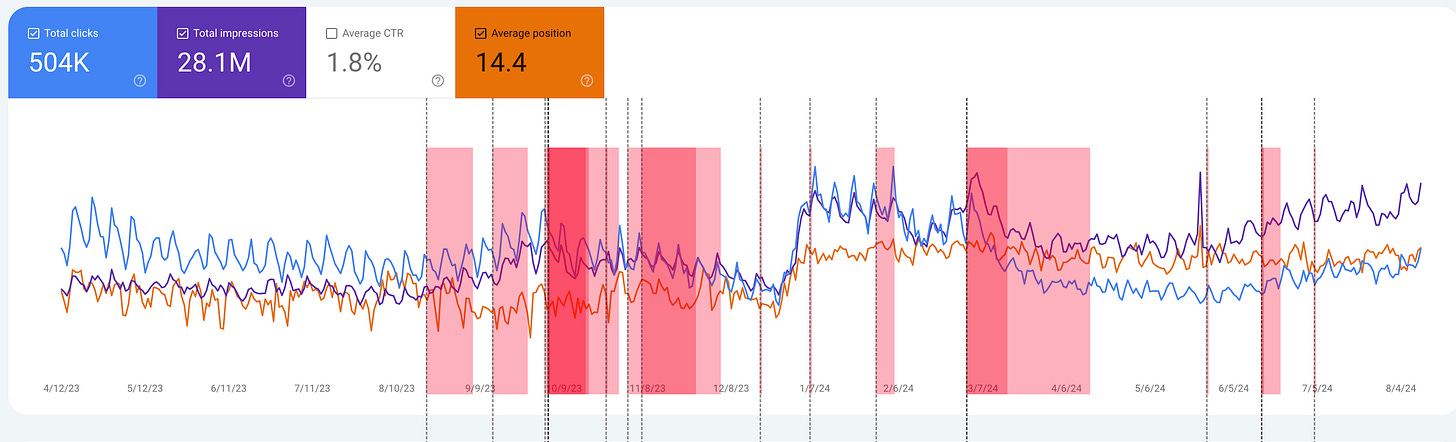

The world of SEO is no different from the stock market. When you’re riding high in Google rankings, it’s easy to feel like you’ve mastered the game.

Keywords are performing, traffic is up, and everyone’s eager to claim their expertise. But here’s the catch—just like a bull run, top rankings don’t last forever.

Google’s algorithm changes can feel like a market crash. One day you’re on top, and the next, you’re scrambling to figure out what went wrong.

This is where thinking like Buffett pays off. Just as he prepares for downturns by booking profits, you should continually optimize and diversify your SEO strategy.

Don’t get complacent with your rankings—focus on building content that’s valuable, authoritative, and built to last.

And just as Buffett buys when others panic, capitalize on SEO opportunities when competitors falter.

If you see them drop in rankings due to an algorithm change, it’s your chance to step in with better content, stronger backlinks, and a more refined strategy.

Takeaways

Whether in the stock market or the world of SEO, don’t get caught up in the highs and lows. Stay focused on the fundamentals, prepare for shifts, and seize opportunities when they arise.

After all, in a bull market or when Google’s on your side, everyone’s an expert. But true success comes when you can thrive, even when the tide turns.

Breakdown of Buffett’s strategy applied to SEO:

End Note

Just like investing, SEO isn’t about riding the highs and lows with the crowd. It’s about staying level-headed, sticking to your principles, and playing the long game. Remember, in a bull market, everyone’s Warren Buffett. In a bear market—or after a Google update? That’s when you find out who really knows what they’re doing.

Author: Hawrry Bhattarai